Black Friday & Cyber Monday Insights: Consumer Trends, Spending Habits, and New Marketing Strategies

Another Black Friday and Cyber Monday have come and gone. For many, it’s a time to relax, spend time with family, and find some great deals. For those of us in marketing, this is our peak season and the work is anything but relaxing. So, as the data pours in here are 3 takeaways from this year.

1. Consumers can’t pass up a deal, especially online.

- In total, consumers spent $9.8 Billion dollars online during Black Friday

- According to Mastercard retail sales on Black Friday were up 2.5% year over year. Over the total season, it forecasts sales to be up 3.7% (11/1 - 12/24)

- eCommerce sales were up 8.5% Year over year, but just 1.1% in-store

2. New Types of Events - This year was the first time there was an NFL game on Black Friday. This event was a part of Amazon’s 11-year deal with the NFL to exclusively broadcast Thursday Night Football. As a result, Amazon took advantage of this event by running many QR promos during the same. They also ran various contests with players and influencers pre-game to promote deals and savings.

Amazon sold out its commercial inventory and gave advertisers a new and measurable way to run “broadcast” TV ads. You did not have to be a prime member to view this game, unlike typical Thursday night deals. Brands also could select their audiences to run ads towards so the promotions were more targeted than other broadcast media might be. You can look for this game and other events to continue this new tradition in the future.

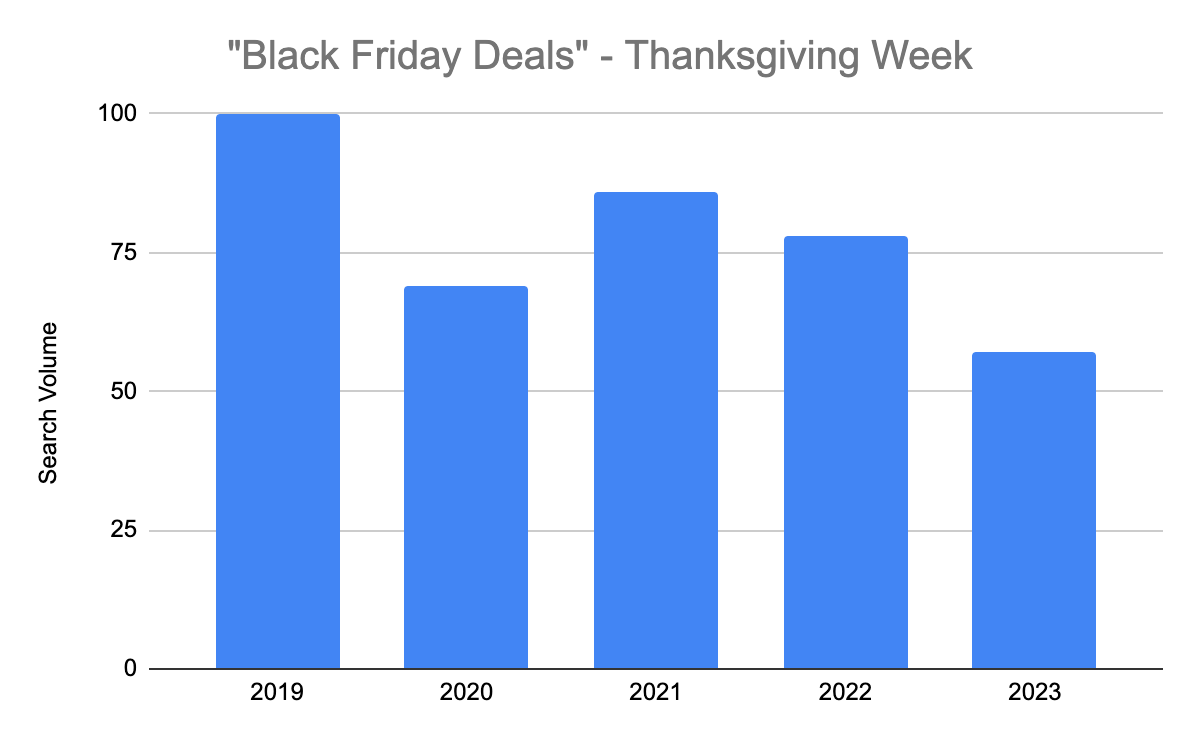

3. The season is longer - The expectation of consumers is to get these deals and brands are starting to run promotions earlier and earlier. This has resulted in consumers changing their search behaviors. In fact, searches for ‘Black Friday Deals’ were lower this year than they were during the pandemic.

4. They are looking for alternative ways to pay.

- Even as interest rates go higher, consumer savings is down after saving during the pandemic and debt is increasing (credit card debt hit a record $1 Trillion for the first time in October) consumers are using Buy Now, Pay Later (BNPL) services. BNPL sales were up 72% vs. the prior week and 47% over the previous year.

These factors give you a sense of how the consumer is responding to this holiday season and can set a broader roadmap for brands moving forward.

Have questions or feedback on these trends? Contact us here and let's chat!

Black Friday & Cyber Monday Insights: Consumer Trends, Spending Habits, and New Marketing Strategies

LET'S TALK ABOUT

YOUR NEXT PROJECT

Choose the service your business needs, or both!